[ad_1]

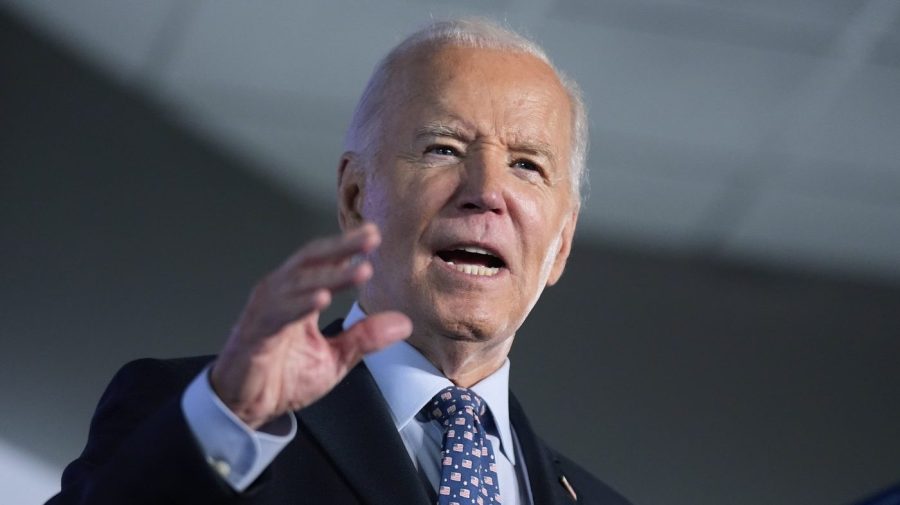

Joe Biden will leave office with the legacy of approving the greatest amount of student debt relief of any president, changing the lives of millions of Americans.

Many of these borrowers waited for years for the forgiveness while paying down their loans, in some cases sacrificing major life events such as buying a home due to their debt.

While grateful to see their loan balance disappear, borrowers who received forgiveness under Biden lament a system they say is holding back millions of others.

“I finally got the loans forgiven in December 2023 and received the zero balance letter. How is it affecting me almost a year later? It really set me back over paying on these loans for years. I never built significant savings at all. I don’t have anything saved. I’m a solo parent, and I do not receive child support,” said Christinia Winton, a mother of two and public servant in Arizona who received loan forgiveness on almost $30,000 through the Public Service Loan Forgiveness (PSLF) program.

The Biden administration forgave some $180 billion of student loans in total, taking away the debt entirely for almost 5 million Americans.

The relief has largely been split up between those on income-driven repayment plans such as PSLF, the borrower defense program that forgives loans to those cheated by their schools and individuals with disabilities.

One of Biden’s accomplishments in office was fixing some of the problems with PSLF, a program meant to give public service workers such as teachers and police a means to receive student debt relief if they make 120 qualifying payments.

Biden made regulatory improvements on the program and gave a one-time count adjustment of payments to help get borrowers on the right track and shorten their repayment time.

Lisa Ansell, an educator from California, was one of the people who got their loans cancelled in 2021 when Biden made those changes, after she was denied eight times.

“I should have been eligible for public service loan forgiveness in 2017, which would have been the first cohort, because public service loan forgiveness was signed into law in 2007 […] I applied in 2017 and, of course, I was denied, no valid reason. We know that the Department of Education likes to invent reasons to prevent people from receiving their lawful cancelation,” said Ansell, the California chapter president for Student Loan Justice.

Ansell said she was relieved, but “what I felt was anger and resentment because I had been kept in indentured servitude to the Department of Education for close to five extra years, and because of that, I was never able to save up any money.”

While Biden forgave the most student debt of any president, his efforts affected only a small portion of the 45 million borrowers.

But not for lack of trying: Biden did attempt to give $10,000 in student loan relief for all borrowers, but it was struck down by the Supreme Court. He also attempted to go through the regulatory process and expand relief to more groups but ran out of time and had to rescind the measure before President-elect Trump returns to office.

Those losses were a significant blow to Biden’s agenda after he pledged sweeping relief on the campaign trail.

“There are people that absolutely feel slighted, and sometimes their anger is maybe, maybe misplaced on the Biden administration,” said Daniel Collier, assistant professor of higher and adult education at the University of Memphis, when asked about borrowers who missed out on relief.

“To be fair to people, though, the Biden administration has done a poor job of communicating with borrowers [what has been accomplished], especially these last few years, especially since the court cases have stalled,” he added.

From borrowers who did get relief, Collier has heard the forgiveness gave them financial stability, career freedom to change jobs after exiting PSLF and a drop in mental distress over worrying about the debt.

The loan forgiveness also takes away a major barrier for young Americans toward purchasing a home.

A 2023 report from the Student Debt Crisis Center found more than half of borrowers with defaulted loans said their student debt prevents them buying a home.

The Hill has reached out to the Biden administration for comment.

“From Day One of my Administration, I promised to make sure that higher education is a ticket to the middle class, not a barrier to opportunity. Because of our actions, millions of people across the country now have the breathing room to start businesses, save for retirement and pursue life plans they had to put on hold because of the burden of student loan debt,” Biden said in December.

Winton, the current president of the Arizona chapter for Student Loan Justice, had to fight her student loan provider who she said lost her payment history, making it incredibly difficult to receive debt relief through PSLF since the servicer could not produce her 120 qualifying payments history.

The delays were costly for her and her children, she said, as they potentially prepare to head to college themselves.

“The result was never [being] able to save for that on their behalf,” she said.

[ad_2]

Source link