People have always been greedy for easy money through games, movement or tapping, but often it ends sadly. Is there a future for earning money for daily actions?

The Hamster Kombat airdrop have saddened thousands, if not millions, of users. However, this scenario is not new — the crypto community has already seen the rapid rise and fall of several mechanics that supposedly allow to earn money for simple actions. What have we learned from that?

Early appearance: hope for stable earnings

The emergence of web3 games has generated massive interest in earning cryptocurrency through fairly simple actions. Play-to-earn (P2E) games became a new type where users can earn cryptocurrency and NFTs through activities.

Axie Infinity was a pioneer in this area. To start the game, users needed initial capital to purchase Axie, a virtual NFT pet. Users could earn tokens by completing tasks, participating in battles with other players, and passing levels in the game. Tokens were exchanged for other digital or fiat currencies, and items could be sold on crypto exchanges and NFT marketplaces.

And, no joke, being a pioneer, the game was considered an option for real earnings for a long time. It gained especially resounding popularity in the Philippines. In 2020, when the whole world was covered by a pandemic, borders were closed, and people began to lose their jobs, enterprising Filipino crypto enthusiasts began to create guilds, offering ordinary users the opportunity to earn money on P2E games.

However, Axie Infinity was ruined by in-game inflation. As a result of its constant growth, the price of its utility token, Smooth Love Potion (SLP), began to decline. To maintain high demand for SLP and AXS (the governance token), an infinite number of new registrations, including players who have neither one nor the other, are needed.

If the number of monthly active users (MAU) was more than 2.7 million at the peak, then in July 2024, this number was just over 310,000. The decline in Axie Infinity indicators occurred during the correction period of the entire digital asset market after Bitcoin (BTC) reached its previous all-time high (ATH) on Nov. 10, 2021.

The large-scale hacking of the game in March 2022 played an essential role in its decline in popularity. The outflow and lack of new users led to the fact that existing users could no longer earn money. The stories of some platform users turned out to be even sadder. In an attempt to make money on investments in the game, some players got into debt. They failed to make money on the project.

Healthy habits replace gaming, but not for long

Against the backdrop of the decline of the P2E games era, a new type of earnings with the move-to-earn mechanics entered the web3 arena. The most famous example of such a game is STEPN.

However, its profitability fell significantly due to an influx of users, and some experts found signs of a financial pyramid in the STEPN mechanics themselves.

At the same time, suspicions about the project do not change the fact that the platform’s early players actually managed to make good money. Users could recoup their investments, while the losses significantly exceeded the earnings for those who joined at the hype stage.

Why did a game aimed at instilling healthy habits fail? The cost maintenance mechanisms laid down by the project’s team did not justify themselves. STEPN was ruined by its popularity: instead of using in-game tokens, Green Satoshi Token (GST), users actively converted them to tradable tokens, Green Metaverse Token (GMT), in the hope of further growth, especially after the rally in the spring of 2022, when the token reached an ATH of $4.11.

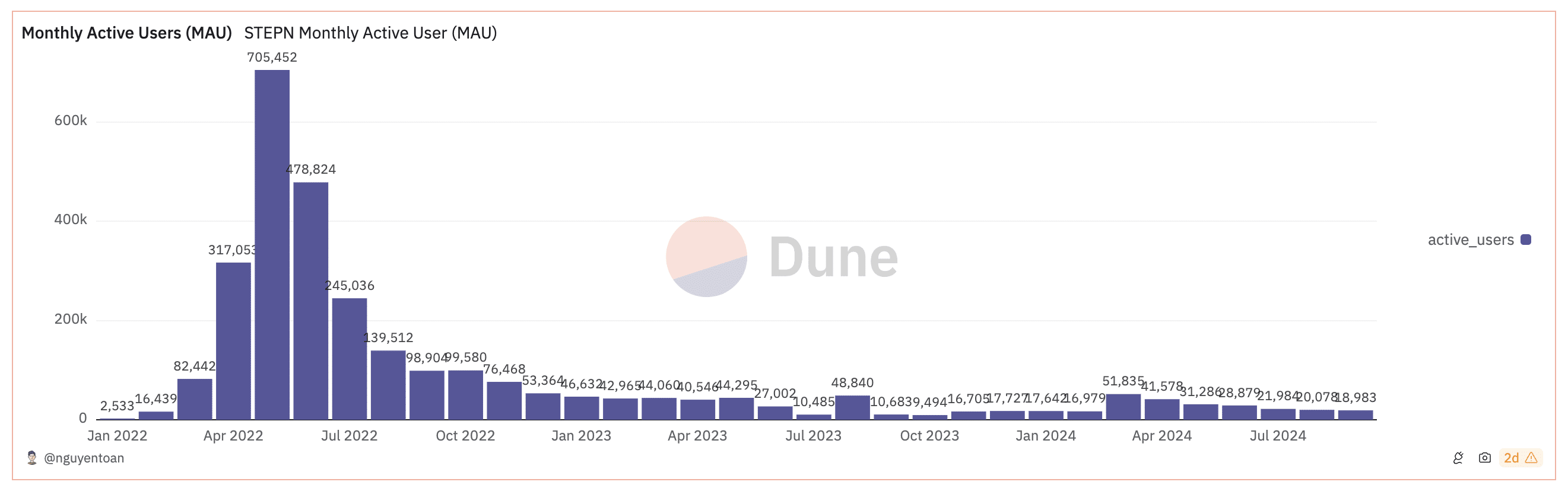

According to Dune, the project also had a significant decrease in MAU — in May 2022, this figure was more than 705,000, then in September 2024, it was already less than 19,000.

The project’s creators on the official website state that the play-to-earn format can be seen as an element of a Ponzi scheme, but STEPN has nothing in common with it. According to them, the developers have built strong tokenomics into the platform, ensuring the project’s coin value stability.

However, in essence, STEPN had no real economy and lived off the money of new users who bought virtual objects for thousands of dollars in the hope of getting their investment back in a couple of months while doing imaginary, useless work.

To maintain the necessary audience activity, a steady influx of new players who would buy game currency and NFT artefacts from old players is required. With a massive influx of new participants, such projects are possible. However, the principle of profit distribution in do-to-earn differs from the classic Ponzi scheme and is more similar to retail trading.

STEPN had been around for a year, and it’s offer to do something simple and get paid for it attracts those who like easy money. At the time of writing, the native GMT token’s price is $0.1464, which is 96% less than ATH.

Mechanics become simpler

Another branch of evolution in the “to-earn” segment was the tap-to-earn mechanic. These games made earning for users even simpler than their predecessors. If earlier players were offered at least some gameplay, then with tap-to-earn, users can earn money by simply tapping the screen.

One of the most popular projects in this segment was Hamster Kombat: with the support of millions of users, the project received a large wave of discontent due to the size of the airdrop.

Were there any signals that could hint at Hamster Kombat’s doom? Of course, it is enough to look at the project’s tokenomics and audience.

Thus, 75% of the token supply is intended for the community. At the same time, a significant part of the audience is newcomers or freebie lovers. Such an audience may be inclined to sell tokens quickly, creating intense pressure on the coin price after the listing. Moreover, the project team has practically not revealed the long-term value of the coin.

Due to its referral mechanics, Hamster Kombat built an impressive base of millions of users. However, this also created an additional risk of the project’s collapse since users rushed to get rid of tokens after the listing.

Will the community learn from past failures?

Yat Siu, co-founder and executive chairman of Animoca Brands, explained in a comment to crypto.news that a significant problem for blockchain games is the lack of established mass distribution channels. Large platforms such as the Apple App Store and Steam often restrict games that include NFTs and limit their mass reach.

“However, as more gamers interact with the blockchain through easily accessible Telegram Mini Apps, we can expect the growing popularity of these products to encourage mainstream game developers to invest more boldly in the web3 gaming industry. This path resembles how early mobile games evolved from a niche despised by much of the traditional gaming industry to a dominant gaming business model.”

Bozena Rezab, co-founder and chairman of GAMEE, on the contrary, is sure that the phenomenon of such games is primarily that they stimulate the mass adoption of cryptocurrencies, which is good for the industry. As an example, she recalled that 131 million users received Hamster Kombat tokens — this figure is much higher than the previous web3 engagement rates, which usually exceeded thousands or maybe tens of thousands of participants.

“This is a clear indication of the potential of casual gaming and Telegram to drive crypto adoption.”

Is there any hope for making money?

Who makes money on to-earn projects? Typically, only the project creators and early participants. The benefit for the user of web3 games regarding receiving real money is quite debatable. On the one hand, there have been successful cases of withdrawing in-game currency; on the other hand, there are so many active users that the developer company cannot cover all the money players earn.

Play-to-earn, move-to-earn, or tap-to-earn projects are ultimately destroyed by their rapid popularity. Most of these popular games are dominated by a pyramid scheme: new players fund old players until interest dries up. At this point, the project is doomed to fail.

Are all easy money projects doomed to fail? Of course not. The main drawbacks of such games are poorly thought-out tokenomics and dependence on a constant influx of new users. Thus, the future of projects with earning mechanics will depend on the ability to implement sustainable business models. However, while the mechanics are predominantly based on a pyramid, the world of web3 games has seen many high-profile ups and downs.