Lagardère’s AGM clarified its ownership to shareholders.

Paris-based Lagardère Travel Retail, the second-biggest airport retailer in the world after Avolta, has offered some color to investors on its approach to the Trump administration’s paused tariffs; a potential partnership with LVMH-owned travel retailer DFS; and the China market.

Parent media-to-retail group Lagardère, with a market capitalization of just over $3 billion, held its annual general meeting on Tuesday when shareholders had the chance to question the company’s executive committee, including chairman and CEO Arnaud Lagardère and CEO of Lagardère Travel Retail Dag Rasmussen.

On whether tariffs might affect Lagardère Travel Retail’s operations in the United States, which are mainly operated through Paradies-Lagardère, Rasmussen said: “We are not impacted by customs rules this year because we have contracts that guarantee prices. We will look at the economic environment, but we are not really concerned by this.”

However, there will be concerns in other areas. In the first quarter of 2025, Lagardère Travel Retail’s North American business was almost flat (up 1%), driven by sales in the travel essentials and dining segments, which helped to offset weaker air traffic growth.

Total global sales in Q1 reached €1.30 billion ($1.47 billion) at the division, up 3.9% like-for-like, highlighting North American—primarily U.S.—helplessness in what is currently an inbound travel and tourism downturn. February and March have already seen Western European traffic to the U.S. slow to +0.2% and -12% respectively, while Canadian traffic fell by -12.5% and -18% in the same months.

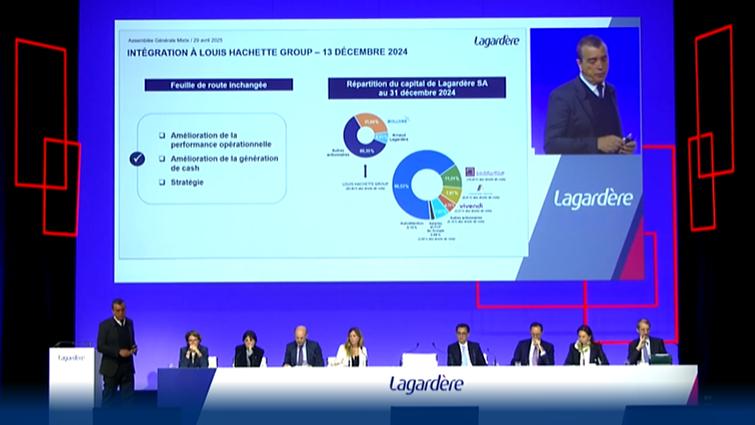

At the AGM, another question was posed about the indirect shareholding of Financière Agache in Lagardère through Louis Hachette Group, the latter now having a direct 66.5% stake in Lagardère. Financière Agache has a near 8% shareholding in Louis Hachette (and 9.6% of voting rights) and is ultimately owned by LVMH’s boss, Bernard Arnault, and his family.

Lagardère cooperation with DFS?

Financière Agache has the controlling shareholdings in Christian Dior and LVMH. Given that travel retailer DFS Group, a possible target for divestment, is part of the LVMH stable, the shareholder asked why DFS and Lagardère Travel Retail could not be merged, or work together.

In reply, Arnaud Lagardère pointed out that DFS’s activities were different from those of Lagardère Travel Retail but that the two groups do speak to one another. Rasmussen added that the strategies of the two companies were not the same. “We have 80% of our business focused on airports, whereas DFS is a big player in downtown duty-free and has positions in China. We’re mostly focused on different regions (so) we don’t see the benefits of grouping the two together,” he said.

More than that, DFS has a long-term commitment to China’s duty-free island of Hainan through a capital-intensive retail infrastructure project with a local partner. Meanwhile, Lagardère Travel Retail is doing the opposite: it is reassessing its China business which falls under the tag of North Asia.

In Q1, the Asia-Pacific region recorded a revenue fall of 20%, “with the decline especially marked in North Asia, down 23%, where our activities are currently restructuring,” said Lagardère Travel Retail in a statement. Asia Pacific in the first quarter accounted for 5% of the division’s total revenue, and that is down from 6% in the whole of 2024.

While China remains a soft market, Arnaud Lagardère was upbeat about travel retail, which makes up about 65% of the group’s revenue and achieved a record recurring EBIT of €305 million, up 24.5% versus 2023. He suggested that new airport infrastructure would underpin growth and commented: “There has been an explosion in airport investment, whether renovations or new builds. We’re seeing huge projects in the Middle East and Asia, while older airports in America are being revamped.”